Virginia National Bank/NB of Commerce, Norfolk, VA (Charter 9885)

Virginia National Bank/NB of Commerce, Norfolk, VA (Chartered 1910 - Closed (Merger) 1995)

Town History

Norfolk (/ˈnɔːrfʊk/ ⓘ NOR-fuk) is an independent city in Virginia. As of the 2020 census, Norfolk had a population of 238,005, making it the third-most populous city in Virginia after neighboring Virginia Beach and Chesapeake, and the 95th-most populous city in the nation. Norfolk holds a strategic position as the historical, urban, financial, and cultural center of the Hampton Roads region (sometimes called "Tidewater"), which has more than 1.8 million inhabitants and is the 37th-largest metropolitan area in the U.S., with ten cities.

In 1634 King Charles I reorganized the Virginia Colony into a system of shires, and Elizabeth Cittie became Elizabeth City Shire. After persuading 105 people to settle in the colony, Adam Thoroughgood (who had immigrated to Virginia in 1622 from King's Lynn, Norfolk, England) was granted a large land holding, through the head rights system, along the Lynnhaven River in 1636. When the South Hampton Roads portion of the shire was separated, Thoroughgood suggested the name of his birthplace for the newly formed New Norfolk County. One year later, it was divided into two counties, Upper Norfolk and Lower Norfolk (the latter now incorporated into the City of Norfolk), chiefly on Thoroughgood's recommendation.

Norfolk was incorporated in 1705. Bordered to the west by the Elizabeth River and to the north by the Chesapeake Bay, the city shares land borders with the independent cities of Chesapeake to its south and Virginia Beach to its east. With coastline along multiple bodies of water, Norfolk has many miles of riverfront and bayfront property, including beaches on the Chesapeake Bay. The coastal zones are important for the economy. The largest naval base in the world, Naval Station Norfolk, is located in Norfolk along with one of NATO's two Strategic Command headquarters. Additionally, Norfolk is an important contributor to the Port of Virginia. It is home to Maersk Line, Limited, which manages the world's largest fleet of US-flag vessels. This low-lying coastal infrastructure is very vulnerable to sea level rise, with water levels expected to rise by more than 5.5 feet by the end of the 21st century.

The city has a long history as a strategic military and transportation point, where many railroad lines started. It is linked to its neighbors by an extensive network of interstate highways, bridges, tunnels, and three bridge-tunnel complexes. The Norfolk Naval Shipyard, often called the Norfolk Navy Yard and abbreviated as NNSY, is a U.S. Navy facility in Portsmouth, Virginia, for building, remodeling and repairing the Navy's ships. It is the oldest and largest industrial facility that belongs to the U.S. Navy as well as the most comprehensive. Located on the Elizabeth River, the yard is just a short distance upriver from its mouth at Hampton Roads.

Norfolk had 10 National Banks chartered during the Bank Note Era, and eight of those banks issued National Bank Notes.

Bank History

- Organized September 30, 1910

- Chartered November 5, 1910

- Succeeded Virginia Bank & Trust Company, Inc. of Norfolk, VA

- 1: Assumed 13343 by consolidation July 30, 1929 (Colonial NB (No Issue), Norfolk, VA)

- 1: Assumed Virginia Bank & Trust Co., Norfolk by consolidation October 16, 1930

- 1: Assumed 6032 by consolidation October 9, 1933 with title change (NB of Commerce/Norfolk NB of Comm, Norfolk, VA)

- 1: Assumed circulation of 6032

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Changed name to Sovran Bank, N.A., Richmond, VA, December 31, 1983

- Merged into NationsBank, N.A. (Carolinas) in Charlotte, NC, September 29, 1995

The Virginia Savings Bank and Trust Company, No. 7 Bank Street, Norfolk, was incorporated March 4, 1902. The officers were James W. Hunter, president; John L. Roper, 1st vice president; Wm. C. Whittle, cashier; and Walter H. Taylor, 2d vice president and general counsel. The directors were Wm. Byrd Page, Robert P. Voight, Frank Hitch, Benjamin P. Loyall, S.S. Nottingham, Southgate Leigh, Theodore S. Garnett, Thomas S. Southgate, S.Q. Collins, R. Henry Jones, Leroy W. Davis, David F. Watt, Robert F. Baldwin, Ralf Margolius, John L. Roper, Walter H. Taylor, Wm. C. Whittle, and James W. Hunter. The bank opened for business on March 17th.[3]

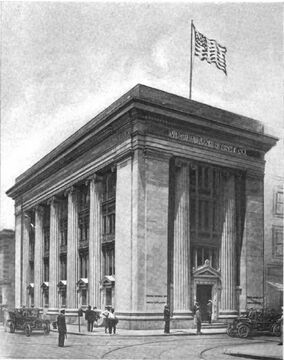

In 1909 records for Norfolk showed that $2,456,953 were invested in building construction during the year distributed over 807 permits compared to $2,100,861 and 793 permits for 1908. Notable new buildings completed or in the course of erection included the new home of the Virginia Bank and Trust Company, Main and Granby Streets, the new Young Men's Christian Association, although far from completion, the new Christ Church, a massive stone edifice, and the Norfolk National Bank's new house on Main Street.[4] On August 13, 1910, the directors of the Virginia Bank and Trust Co. met and passed the preliminary resolutions for the formation of the Virginia National Bank of Norfolk. The new national bank would occupy the building of the Virginia Bank and Trust Co. and would be run in connection with that bank with the same officers. The present officers and directors were James K. Hunter, president; John L. Roper, first vice president; Wm. C. Whittle, second vice president; Hugh G. Whitehead, cashier; Washington Reed, assistant cashier; and Walter H. Taylor, general counsel. The directors were Wm. Byrd Page, Thos. S. Southgate, S.Q. Collins, Charles H. Consolvo, Theo. S. Garnett, Walter H. Taylor, Wm. C. Whittle, Dr. Southgate Leigh, S.S. Nottingham, Benj. Margolius, Lucien D. Starke, James W. Hunter, W.F. Shumadine, Robert F. Baldwin, G.S. Friebus, John L. Roper, A.E. Kellam, W.W. Robertson, and E.R. Baird, Jr.[5]

On Wednesday, November 16, 1910, the Virginia National Bank of Norfolk opened for business. The capital was $500,000 and the surplus was $100,000. The Virginia Bank and Trust Co., Inc., operated trust, savings and bond departments and the capital stock was owned by the stockholders of the Virginia National Bank.[6] The bank opened in the fine new building at Main and Granby Streets and was the third national bank in Norfolk, the others being the National Bank of Commerce and the Norfolk National Bank. In January the same officers were re-elected to serve during the ensuing year. The same officers were also chosen for the Virginial Bank and Trust Co., an affiliated institution.[7]

On Tuesday, January 14, 1913, the annual meeting of the stockholders was held at the banking house, 4 Granby Street. The directors were Geo. W. Roper, Thos. S. Southgate, S.Q. Collins, Charles H. Consolvo, Theo. S. Garnett, Walter H. Taylor, Wm. C. Whittle, Dr. Southgate Leigh, S.S. Nottingham, Benj. Margolius, Lucien D. Starke, James W. Hunter, W.F. Shumadine, Robert F. Baldwin, G.S. Friebus, John L. Roper, A.E. Kellam, E.R. Baird, Jr., and Hugh G. Whitehead. The officers were James W. Hunter, president; John L. Roper, 1st vice president; William C. Whittle, 2d vice president; Hugh G. Whitehead, cashier; Washington Reed, assistant cashier; and Walter H. Taylor, general counsel.[8]

In January 1915, the following officers were re-elected to serve another term: James W. Hunter, president; John L. Roper, first vice president; William C. Whittle, second vice president; Hugh G. Whitehead, cashier; Washington Reed, assistant cashier; and Walter H Taylor, general counsel.[9]

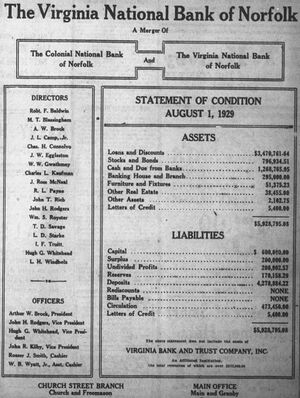

In June 1929, the Colonial National Bank of Norfolk with a capital of $475,000 and surplus or undivided profits of $285,000, was organized with local capital for the purpose of consolidating with the Virginia National Bank. Directors of the two institutions would meet separately within a few days to call a meeting of their respective stockholders to ratify the merger as prescribed by law. Directors of the new bank named in the articles of association were: J.L. Camp, Jr., head of the Camp Manufacturing Company of Franklin, one of the largest lumber concerns in the South; Charles L. Kaufman, Norfolk lawyer; J. Ross McNeal, prominent lumberman and connected with several other large businesses; L. Payne, Norfolk physician; John H. Rodgers, head of the John H. Rodgers & Co., cotton concern and other large operations; John T. Rich, secretary and treasurer of John H. Rodgers & Co.; William S. Royster, vice president of the F.S. Royster Guano Co., chairman of the board of managers of the Morris Plan Bank of Virginia, president of the Norfolk Community Fund; and Toy D. Savage, Norfolk lawyer. The merger would give Norfolk another substantial increase in banking facilities and resources. Three years earlier the Norfolk National Bank and Trust Co. merged with the National Bank of Commerce and a year earlier the Citizens Bank and Seaboard National Bank merged. This was in line with a general tendency throughout the country to consolidate banking facilities. More recently the Merchants and Mechanics Savings Bank of Norfolk increased its capital stock substantially in order to meet the demand of increased business.[11]

On July 29, 1929, stockholders of the two institutions in separate meetings ratified the consolidation, effective on the 30th subject to approval by the Comptroller of the Currency. Arthur W. Brock, vice president of the Norfolk National Bank of Commerce and Trusts and lately in charge of its Granby Street office was selected as president of the Virginia National Bank of Norfolk. Hugh G. Whitehead, president of the Virginia National Bank was a new vice president as were John H. Rodgers, one of the principal stockholders of the Colonial, and John R. Kilby, vice president and trust officer. Rosser J. Smith was the cashier and W.B. Wyatt, Jr., assistant cashier. The latter three were serving in the Virginia National Bank. R.H. Moore, assistant cashier of the Norfolk National Bank of Commerce and Trusts was transferred to the Granby Street office to fill the vacancy created by Mr. Brock's retirement. Mr. Moore began his banking career as a runner in the Norfolk National Bank in 1899. The consolidated bank would use the quarters of the Virginia National Bank. The Virginia Bank and Trust Company, a state institution owned by the stockholders of the Virginia National Bank would continue in operation after the merger. The Church Street branch would become part of the consolidation and be continued in operation for the convenience of patrons in that section of the city. Merger would give the consolidated bank a capital surplus and profits in excess of $1,000,000, deposits in excess of $4,000,000 and resources of approximately $6,500,000.[12]

On Wednesday, September 10, 1930, the consolidation of the Virginia National Bank of Norfolk and its affiliated state bank, the Virginia Bank and Trust Company, Inc., was approved by the board of directors of the institutions, subject to approval by stockholders. The only important functions performed by the Virginia Bank and Trust Co. since the 1929 consolidation with the Colonial National Bank was the operation of a branch bank at Virginia Beach for deposits only. This branch would continue in operation as a branch of the Virginia National Bank. The fiduciary business of the Virginia Bank and Trust Co. would be taken over into the trust department of the Virginia National. No investment business had been conducted for over a year and none would be conducted after the consolidation as proposed. Resources of the trust company were $700,000 and its deposits $600,000. The officers of both institutions were the same. They were A.W. Brock, president; John H. Rodgers, vice president; Hugh G. Whitehead, vice president and cashier; W.B. Wyatt, Jr., Edward L. Hill, assistant cashiers; Lewis Bress, manager, Church Street Branch; and M.F. Parker, manager, Virginia Beach Branch. The directors were: M.T. Blassingham, A.W. Brock, J.L. Camp, Jr, Charles H. Consolvo, J.W. Eggleston, W.W. Gwathmey, Charles L. Kaufman, J. Ross McNeal, R.L. Payne, John T. Rich, John H. Rodgers, William S. Royster, T.D. Savage, H.C. Smither, L.D. Starke, W.F. Taylor, I.F. Truitt, Hugh G. Whitehead, and L.H. Windholz. Mr. Taylor, president of the Southgate-Nelson Corporation was elected a member of the board on this day.[13]

On October 10, 1933, the National Bank of Commerce of Norfolk was formed through the merger of Norfolk National Bank of Commerce and Trusts and the Virginia National Bank. The new bank had 6 offices located at Main Street at Atlantic, Granby Street at City Hall Avenue, Hampton Boulevard at 38th Street, Church and Freemason Streets, Ocean view at Granby Street, and Virginia Beach at Atlantic Avenue. The officers were Robert P. Beaman, president; C.W. Grandy, inactive vice president; Jas. B. Dey, Jr., Senior vice president; A.B. Schwarzkopf, A.W. Brock, C.S. Whitehurst, vice presidents; I.T. Van Patten, Jr., assistant vice president; John S. Alfriend, cashier; R. Cornelius Taylor, C.S. Phillips, J.J. Schmoele, E.D. Denby, R.H. Moore, S.E. Tudor, S.T. Northern, W.B. Wyatt, Jr., and C.M. Etheridge, assistant cashiers; J.H. Fanshaw, auditor; and Charles Webster, vice president and trust officer.[14]

On Thursday, January 10, 1963, John S. Alfriend, chairman of the board of National Bank of Commerce of Norfolk and W.S. Hildreth, chairman of the board of Peoples National Bank of Central Virginia, announced plans for the formation of a new statewide banking institution to be known as the Virginia National Bank, subject to approval by shareholders and appropriate authorities. The board of directors of both banks approved the consolidation of Virginia's third and seventh largest banks at separate meetings on Wednesday. The new bank would have capital in excess of $27 million, resources of approximately $350 million and would rank second in size among all Virginia banks. It would operate 32 offices in 12 Virginia communities. Executive management would be divided between top officers of the two existing institutions. John S. Alfriend would become chairman of the board and chief executive office while both W.S. Hildreth and R. Cosby Moore, presently president of the National Bank of Commerce, would become vice chairman of the board. W. Wright Harrison, president of Peoples National would become president of the new bank. Other officers and employees of both banks would continue in their present capacities. Under the terms of the consolidation agreement, the $5 par value shares of each bank would be exchanged on a share for share basis for stock in the Virginia National Bank which would also have a $5 par value. Virginia National Bank would have 1,372,421 shares of common stock. There were 800,000 shares of National Bank of Commerce stock and 572,421 shares of Peoples National stock. The book value per share of the stock of both banks was approximately the same.[16] On Wednesday, April 3, 1963, stockholders of the National Bank of Commerce of Norfolk and stockholders of the Peoples National Bank of Central Virginia voted heavily in favor of the proposed consolidation of the two banks into one new bank to be known as the Virginia National Bank. W. Wright Harrison, president of the Peoples National Bank with a branch in Orange would be president of the new Virginia National Bank. He told stockholders that approval by the comptroller of the currency was expected within 10 days and the target date for the actual consolidation of the two banks was the close of business on Friday, April 26th.[17]

All of the banks in Norfolk now had entered into mergers or been acquired by holding companies since the General Assembly changed the banking laws in 1962.[18]

In January 1970, Virginia National, the state's largest bank with headquarters in Norfolk, operated 98 offices in 49 communities. It had pending mergers with the First National Bank of Harrisonburg which would add three offices in that community and with Merchants and Farmers Bank of Smithfield which would add an additional office in that southside community. On June 30, 1969, the bank ranked 77th in size among the more than 13,000 commercial banks in the nation. It reported net operating income after taxes of nearly $8 million, up 11.8% from 1968.[20][21]

- 03/16/1970 Acquired The First National Bank of Harrisonburg (Charter 1572) (FDIC #6856) in Harrisonburg, VA.

- 06/01/1970 Acquired The Merchants and Farmers Bank (FDIC #834) in Smithfield, VA.

- 11/23/1970 Acquired Carroll County Bank (FDIC #9505) in Hillsville, VA.

- 01/03/1972 Main Office moved to One Commercial Street, Norfolk, VA 23510. Now 321 E. Main Street, Icon Norfolk (formerly Bank of America Center)

- 03/15/1976 Acquired North American Bank and Trust (FDIC #20690) in Leesburg, VA.

- 11/12/1976 Acquired Fairfax County National Bank (FDIC #17826) in Seven Corners, VA.

- 11/30/1977 Acquired Virginia National Bank/Fairfax (FDIC #20337) in Springfield, VA.

- 09/01/1978 Acquired Virginia National Bank/Richmond (FDIC #12656) in Richmond, VA.

- 09/01/1978 Acquired Virginia National Bank/Lynchburg (FDIC #20238) in Lynchburg, VA.

- 06/01/1979 Acquired New Bank of Roanoke (FDIC #21774) in Roanoke, VA.

- 04/30/1981 Acquired The First National Bank of Troutville (FDIC #6922) in Troutville, VA.

- 08/01/1981 Acquired The Farmers Exchange Bank of Coeburn (FDIC #9508) in Coeburn, VA.

- 11/14/1981 Acquired Old Colony Bank and Trust Company (FDIC #20868) in James City County, VA.

- 06/14/1982 Acquired First National Bank of South Boston (FDIC #15114) in South Boston, VA.

- 08/09/1982 Acquired First National Bank of Wise (FDIC #20718) in Wise, VA.

- 08/16/1982 Acquired The Northern Virginia Bank (FDIC #17737) in Springfield, VA.

- 08/16/1982 Acquired First City Bank of Newport News (FDIC #20018) in Newport News, VA.

- 10/25/1982 Acquired First National Bank of Fries (FDIC #6847) in Fries, VA.

- 11/12/1982 Acquired Farmers Bank of Mathews (FDIC #10369) in Mathews, VA.

- 12/31/1983 Changed Institution Name to Sovran Bank, National Association.

- 12/31/1983 Main Office moved to 1111 East Main Street, Richmond, VA 23261.

- 12/31/1983 Acquired The Wise County National Bank (FDIC #6887) in Wise, VA.

- 12/31/1983 Acquired First & Merchants National Bank (Charter 1111) (FDIC #6902) in Richmond, VA.

- 12/28/1985 Acquired Virginia Southern Bank (FDIC #21228) in Clarksville, VA.

- 01/01/1992 Changed Institution Name to Nationsbank of Virginia, National Association.

- 03/31/1992 Acquired NCNB Virginia (FDIC #20545) in Mclean, VA.

- 03/08/1995 Changed Institution Name to NationsBank, National Association.

- 03/08/1995 Acquired NationsBank, National Association (FDIC #12883) in Mclean, VA.

- 09/29/1995 Merged and became part of NationsBank, National Association (Carolinas) (FDIC #15802) in Charlotte, NC.

- 07/05/1999 Changed Institution Name to Bank of America, National Association.

- 07/23/1999 Merged and became part of Bank of America National Trust and Savings Association (FDIC #3510) in San Francisco, CA.

Official Bank Titles

1: The Virginia National Bank of Norfolk, VA

2: National Bank of Commerce of Norfolk, VA (10/9/1933)

Bank Note Types Issued

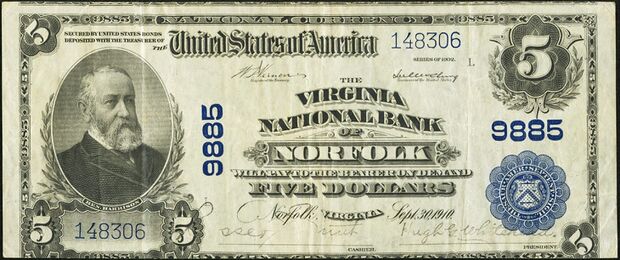

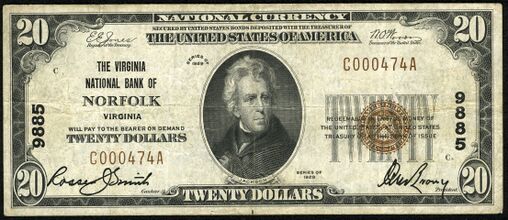

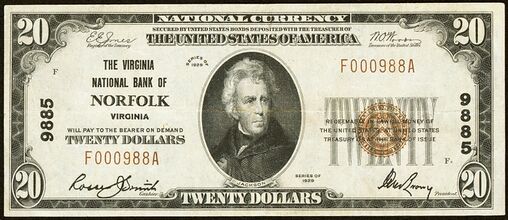

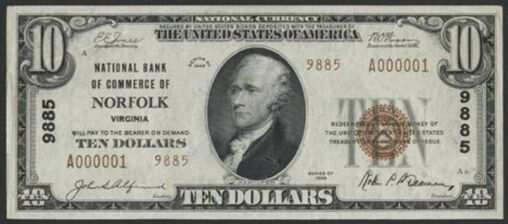

A total of $11,610,420 in National Bank Notes was issued by this bank between 1910 and 1935. This consisted of a total of 1,441,714 notes (999,768 large size and 441,946 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1: 1902 Date Back 4x5 1 - 45750 1: 1902 Date Back 3x10-20 1 - 35300 1: 1902 Plain Back 4x5 45751 - 148670 1: 1902 Plain Back 3x10-20 35301 - 101272 1: 1929 Type 1 6x5 1 - 24722 1: 1929 Type 1 6x10 1 - 12490 1: 1929 Type 1 6x20 1 - 3224 1: 1929 Type 2 5 1 - 11052 1: 1929 Type 2 10 1 - 4992 1: 1929 Type 2 20 1 - 1260 2: 1929 Type 2 5 1 - 85548 1747-1752 Not issued 2: 1929 Type 2 10 1 - 79217 2: 1929 Type 2 20 1 - 17261

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1910 - 1935):

Presidents:

- James Wilson Hunter Sr., 1911-1919

- Hugh Grigsby Whitehead, 1920-1928

- Arthur Wilson Brock, 1929-1932

- Robert Prentis Beaman, 1933-1935

Cashiers:

- Hugh Grigsby Whitehead, 1911-1919

- Mars Lewis, 1920-1924

- David Marshall Hale, 1925-1925

- Rosser Jefferson Smith Sr., 1927-1929

- Hugh Grigsby Whitehead, 1930-1932

- John S. Alfriend, 1933-1935

Other Known Bank Note Signers

- James Benjamin Dey, Jr., Vice President 1933

- Cyrus Wiley Grandy, Vice President 1933

- Albert Beauregard Schwarzkopf, Vice President 1933

Bank Note History Links

Sources

- Norfolk, VA, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol. 89, July - Dec. 1914, p. 322.

- ↑ Ledger-Star, Norfolk, VA, Tue., Mar. 28, 1911.

- ↑ The Virginian-Pilot, Norfolk, VA, Thu., Mar. 13, 1902.

- ↑ Ledger-Star, Norfolk, VA, Mon., Jan. 31, 1910.

- ↑ Ledger-Star, Norfolk, VA, Sat., Aug. 13, 1910.

- ↑ Ledger-Star, Norfolk, VA, Fri., Nov. 18, 1910.

- ↑ Ledger-Star, Norfolk, VA, Wed., Jan. 18, 1911.

- ↑ The Virginian-Pilot, Norfolk, VA, Thu., Mar. 21, 1912.

- ↑ The Virginian-Pilot, Norfolk, VA, Thu., Jan. 21, 1915.

- ↑ The Virginian-Pilot, Norfolk, VA, Sat., Aug. 3, 1929.

- ↑ The Virginian-Pilot, Norfolk, VA, Fri., June 21, 1929.

- ↑ The Virginian-Pilot, Norfolk, VA, Tue., July 30, 1929.

- ↑ The Virginian-Pilot, Norfolk, VA, Thu., Sep. 11, 1930.

- ↑ Ledger-Star, Norfolk, VA, Tue., Oct. 10, 1933.

- ↑ Ledger-Star. Norfolk, VA, Wed., Jan. 30, 1963.

- ↑ Orange County Review, Orange, VA, Thu., Jan. 10, 1963.

- ↑ Orange County Review, Orange, VA, Thu., Apr. 4, 1963.

- ↑ The Virginian-Pilot, Norfolk, VA, Fri., June 14, 1963.

- ↑ Suffolk News-Herald, Suffolk, VA, Sun., May 24, 1964.

- ↑ The Bee, Danville, VA, Wed., Jan. 7, 1970.

- ↑ The Roanoke Times, Roanoke, VA, Sat., Mar. 14, 1970.